Housing turnover reaches the highest level in nearly 12 years

The highest number of annual sales since 2004 occurred across Australia over the year ending August 2021, 42% more than the previous period. Turnover was the highest in Queensland, where 6.8% of properties transacted over this period, the state’s strongest turnover level since the 12-months ending June 2008.

Guess what the median Australian house price was in 1976?

If we haven’t personally looked back on a property that, in retrospect, we could have bought for next to nix, then we know someone who does.

Refinancing is at a record high, but why now?

The Australian Bureau of Statistics (ABS) released its lending indicators from July 2021 which revealed that refinancing reached a record-breaking high of $17.2 billion.

Monetary Policy Decision Aug 2021

Source: Reserve Bank of Australia | Number 2021-14 At its meeting today, the Board decided to: • maintain the cash rate target at 10 basis points and the interest rate on Exchange Settlement balances of zero per cent • maintain the target of 10 basis points for the April 2024 Australian Government bondcontinue to purchase gover...

Highest annual rate of growth since 2004

Australian housing values increased a further 1.6% in July, according to CoreLogic’s national home value index.The latest rise takes housing values 14.1% higher over the first seven months of the year and 16.1% higher over the past twelve months.The market is strong but losing steam, the 16.1% lift in national housing values over the past year is the fastest pace of annual growth since February...

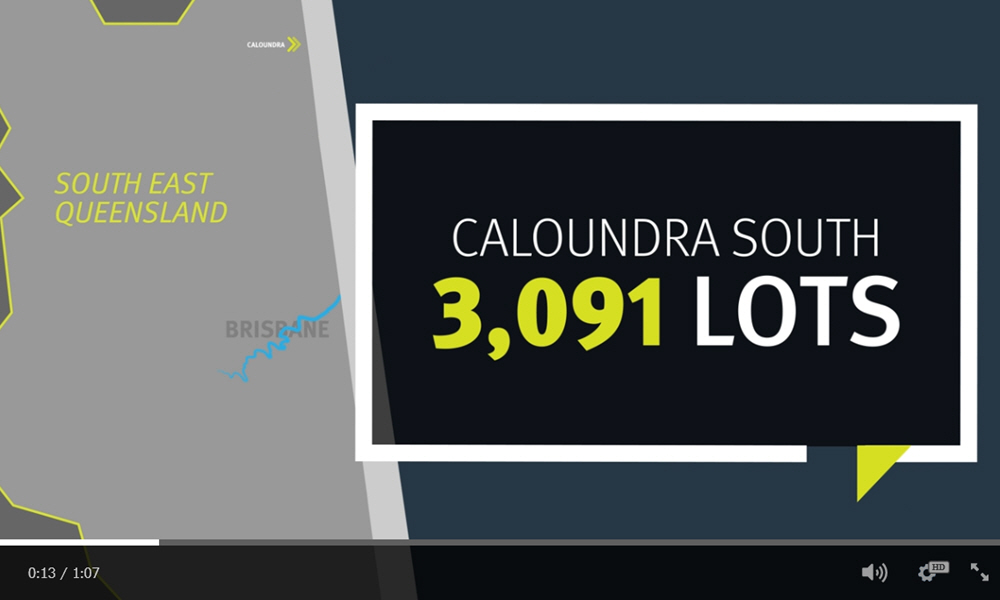

50,000 lots unlocked in SEQ to meet land demand

Source: Queensland Government Almost 50,000 residential lots are being unlocked in South East Queensland since the 2020 State election, helping to cater for the region’s current and projected population surge.The lots have been made possible following the creation of the Growth Areas Team and thanks to more than $92 million in targeted funding from the Palaszczuk Government.Deputy Premier...

Will Queensland's Property Prices Win Gold After the 2032 Olympics?

Although some 11 years away, the 2032 Olympic Games is on the lips of most Queenslanders – particularly among Brisbanites – whose home city has been declared host of the event. However, it’s not just the excitement of the world’s largest multi-sport event that has tongues wagging. Hosting the 2032 Olympics and Paralympics could be a “game...

Property sales now 60% higher than both 2019 and 2020

Author: Bianca Dabu | Source: Real Estate BusinessSales have soared by over 60 per cent compared with 2020 and 2019 in what’s a testament to the continued recovery of the property market, a new report has revealed.REA Insights’ latest Housing Market Indicators Report found that preliminary weekly sales over the first six months of the year were 60.7 per cent higher than the same period las...

Australia's Property Market Pressure Index

Source: Propertyology With property prices rising all over Australia the degree of pressure within property markets has reached all-time record levels.Australia's rising-tides-lifts-all-ships property market is currently underpinned by two common denominators: on the deman side is record low interest rates while the volume of dwellings listed for sale is as tight as a mouse in a matchbox.Contra...