Monetary Policy Decision Aug 2021

Source: Reserve Bank of Australia | Number 2021-14

At its meeting today, the Board decided to:

• maintain the cash rate target at 10 basis points and the interest rate on Exchange Settlement balances of zero per cent

• maintain the target of 10 basis points for the April 2024 Australian Government bond

continue to purchase government securities at the rate of $5 billion a week until early September and then $4 billion a week until at least mid November.

The economic recovery in Australia has been stronger than was earlier expected. The recent outbreaks of the virus are, however, interrupting the recovery and GDP is expected to decline in the September quarter. The experience to date has been that once virus outbreaks are contained, the economy bounces back quickly. Prior to the current virus outbreaks, the Australian economy had considerable momentum and it is still expected to grow strongly again next year. The economy is benefiting from significant additional policy support and the vaccination program will also assist with the recovery.

The economic outlook for the coming months is uncertain and depends upon the evolution of the health situation and the containment measures. Beyond that, the Bank's central scenario is for the economy to grow by a little over 4 per cent over 2022 and by around 2½ per cent over 2023. This scenario is based on a significant share of the population being vaccinated by the end of this year and a gradual opening up of the international border from the middle of 2022. The Board also considered a range of other scenarios, with the main source of uncertainty being the health situation.

The labour market has recovered faster than expected, with the unemployment rate declining further to 4.9 per cent in June. Job vacancies have remained at a high level and there are reports of labour shortages in parts of the economy. Some increase in the unemployment rate is expected in the near term due to the current lockdowns, but most of the adjustment in the labour market is likely to take place through a reduction in hours worked and in participation. In the central scenario, the unemployment rate continues to trend lower next year, to be around 4¼ per cent at the end of 2022 and 4 per cent at the end of 2023.

The CPI inflation rate spiked to 3.8 per cent for the year to the June quarter, largely reflecting the unwinding of some earlier COVID-19-related price declines. In underlying terms, inflation remains low, at around 1¾ per cent.

Looking forward, a pick-up in both wages growth and underlying inflation is expected, but this pick-up is likely to be only gradual. In the Bank's central scenario, it takes some years for the stronger economy to feed through into wage and price increases that are consistent with the inflation target. In underlying terms, inflation is expected to be 1¾ per cent over 2022 and 2¼ per cent over 2023. One source of uncertainty is the behaviour of wages and prices at the low levels of forecast unemployment, including because it is some decades since Australia has sustained an unemployment rate around 4 per cent.

Housing markets have continued to strengthen, with prices rising in all major markets. Housing credit growth has picked up, with strong demand from owner-occupiers, including first-home buyers. There has also been increased borrowing by investors. Given the environment of rising housing prices and low interest rates, the Bank is monitoring trends in housing borrowing carefully and it is important that lending standards are maintained.

Domestic financial conditions remain very accommodative, sovereign bond yields have declined and the exchange rate has depreciated to around its lowest level this year, despite elevated levels of commodity prices. The recent fiscal responses by the Australian Government and the state and territory governments are also providing welcome support to the economy at a time of significant short-term disruption.

The Board remains committed to maintaining highly accommodative monetary conditions to support a return to full employment in Australia and inflation consistent with the target. Together, the low level of the cash rate, the bond purchase program, the yield target and the ongoing funding that has been provided under the Term Funding Facility are providing substantial support to the Australian economy in the face of lockdowns in parts of the country and the expected resumption of the economic expansion.

The Board will maintain its flexible approach to the rate of bond purchases. The program will continue to be reviewed in light of economic conditions and the health situation, and their implications for the expected progress towards full employment and the inflation target. The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The central scenario for the economy is that this condition will not be met before 2024. Meeting this condition will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently.

Enquiries

Secretary's Department

Reserve Bank of Australia

SYDNEYPhone: +61 2 9551 9720

Email: [email protected]

Statement by Philip Lowe, Governor: Monetary Policy Decision

At its meeting today, the Board decided to:

• retain the April 2024 bond as the bond for the yield target and retain the target of 10 basis points

• continue purchasing government bonds after the completion of the current bond purchase program in early September. These purchases will be at the rate of $4 billion a week until at least mid November

• maintain the cash rate target at 10 basis points and the interest rate on Exchange Settlement balances of zero per cent.

These measures will provide the continuing monetary support that the economy needs as it transitions from the recovery phase to the expansion phase. The Board is committed to achieving the goals of full employment and inflation consistent with the target. Today's decisions, together with those taken previously, have the economy on a path to achieve those objectives.

The economic recovery in Australia is stronger than earlier expected and is forecast to continue. The outlook for investment has improved and household and business balance sheets are generally in good shape. National income is also being supported by the high prices for commodity exports. Domestic financial conditions are very supportive and the exchange rate has depreciated a little recently. One near-term uncertainty is the effect of the recent virus outbreaks and the lockdowns. But the experience to date has been that once outbreaks are contained and restrictions are eased, the economy bounces back quickly.

The labour market has continued to recover faster than expected. The unemployment rate declined further to 5.1 per cent in May and more Australians have jobs than before the pandemic. There has also been a welcome decline in underemployment and labour force participation is around record highs. Job vacancies are high and more firms are reporting shortages of labour, particularly in areas affected by the closure of Australia's international borders.

Despite the strong recovery in jobs and reports of labour shortages, inflation and wage outcomes remain subdued. While a pick-up in inflation and wages growth is expected, it is likely to be only gradual and modest. In the central scenario, inflation in underlying terms is expected to be 1½ per cent over 2021 and 2 per cent by mid 2023. In the short term, CPI inflation is expected to rise temporarily to about 3½ per cent over the year to the June quarter because of the reversal of some COVID-19-related price reductions a year ago.

Maintaining the target of 10 basis points for the April 2024 bond will continue to keep interest rates low at the short end of the yield curve and support low funding costs in Australia. The yield on this bond is consistent with the target and the RBA remains prepared to operate in the market to achieve the target.

The bond purchase program is playing an important role in supporting the Australian economy. The Bank will continue to purchase bonds given that we remain some distance from the inflation and employment objectives. However, the Board is responding to the stronger-than-expected economic recovery and the improved outlook by adjusting the weekly amount purchased. It will conduct a further review in November, allowing the Board to respond to the state of the economy at that time.

The final draw-downs under the Term Funding Facility were made in late June. In total, $188 billion has been drawn down under this facility, which has contributed to the Australian banking system being highly liquid. Given that the facility is providing low-cost fixed-rate funding for 3 years, it will continue to support low borrowing costs until mid 2024.

Housing markets have continued to strengthen, with prices rising in all major markets. Housing credit growth has picked up, with strong demand from owner-occupiers, including first-home buyers. There has also been increased borrowing by investors. Given the environment of rising housing prices and low interest rates, the Bank will be monitoring trends in housing borrowing carefully and it is important that lending standards are maintained.

The Board remains committed to maintaining highly supportive monetary conditions to support a return to full employment in Australia and inflation consistent with the target. It will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The Bank's central scenario for the economy is that this condition will not be met before 2024. Meeting it will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently.

Enquiries

External Communications

Secretary's Department

Reserve Bank of Australia

SYDNEY

Phone: +61 2 9551 9720

Email: [email protected]

![]()

Statement by Philip Lowe, Governor: Monetary Policy Decision May 2021

4 May 2021 | Source: Reserve Bank of Australia

At its meeting today, the Board decided to maintain the current policy settings, including the targets of 10 basis points for the cash rate and the yield on the 3-year Australian Government bond, as well as the parameters of the Term Funding Facility and the government bond purchase program.

The global economy is continuing to recover from the pandemic and the outlook is for strong growth this year and next. The recovery remains uneven, though, and some countries are yet to contain the virus. Global trade in goods has picked up strongly and commodity prices are mostly higher than at the start of the year. However, inflation remains low and below central bank targets.

Sovereign bond yields have been steady recently after increasing earlier in the year due to the positive news on vaccines and the additional fiscal stimulus in the United States. Inflation expectations have lifted from near record lows to be closer to central banks' targets. The 3-year government bond yield in Australia is at the Board's target of 10 basis points and lending rates for most borrowers are at record lows. The Australian dollar remains in the upper end of the range of recent years.

The economic recovery in Australia has been stronger than expected and is forecast to continue. This recovery is especially evident in the strong growth in employment, with the unemployment rate falling further to 5.6 per cent in March and the number of people with a job now exceeding the pre-pandemic level.

The Bank's central scenario for GDP growth has been revised up further, with growth of 4¾ per cent expected over 2021 and 3½ per cent over 2022. A pick-up in business investment is expected and household spending will be supported by the strengthening in balance sheets over the past year. The unemployment rate is expected to continue to decline, to be around 5 per cent at the end of this year and around 4½ per cent at the end of 2022.

Despite the strong recovery in economic activity, the recent CPI data confirmed that inflation pressures remain subdued in most parts of the Australian economy. A pick-up in inflation and wages growth is expected, but it is likely to be only gradual and modest. In the central scenario, inflation in underlying terms is expected to be 1½ per cent in 2021 and 2 per cent in mid 2023. In the short term, CPI inflation is expected to rise temporarily to be above 3 per cent in the June quarter because of the reversal of some COVID-19-related price reductions.

Housing markets have strengthened further, with prices rising in all major markets. Housing credit growth has picked up, with strong demand from owner-occupiers, especially first-home buyers. Given the environment of rising housing prices and low interest rates, the Bank will be monitoring trends in housing borrowing carefully and it is important that lending standards are maintained.

At its July meeting, the Board will consider whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity, the November 2024 bond. The Board is not considering a change to the target of 10 basis points. At the July meeting, the Board will also consider future bond purchases following the completion of the second $100 billion of purchases under the government bond purchase program in September. The Board is prepared to undertake further bond purchases to assist with progress towards the goals of full employment and inflation. The Board places a high priority on a return to full employment.

The date for final drawings under the Term Funding Facility is 30 June 2021. Given that financial markets in Australia are operating well, the Board is not considering a further extension of this facility. Authorised deposit-taking institutions have drawn $100 billion so far and a further $100 billion is currently available. Given the facility provides funding for 3 years, it will continue to support low funding costs in Australia until mid 2024.

The Board is committed to maintaining highly supportive monetary conditions to support a return to full employment in Australia and inflation consistent with the target. It will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest.

Enquiries

Media and Communications

Secretary's Department

Reserve Bank of Australia

SYDNEY

Phone: +61 2 9551 9720

Email: [email protected]

![]()

Cash Rate On Hold at 0.10%

6 April 2021 | Source: Real Estate Investar

Statement by Philip Lowe, Governor: Monetary Policy Decision

At its meeting today, the Board decided to maintain the current policy settings, including the targets of 10 basis points for the cash rate and the yield on the 3-year Australian Government bond, as well as the parameters of the Term Funding Facility and the government bond purchase program.

Graph of the Cash Rate Target

Recovery of the Global Economy

The rollout of vaccines is supporting the recovery of the global economy, although the recovery is uneven. While there are still considerable uncertainties regarding the outlook, the central case has improved.

Global trade has picked up and commodity prices are mostly higher than at the start of the year. Inflation remains low and below central bank targets.

Sovereign bond yields have increased over recent months due to the positive news on vaccines and the additional fiscal stimulus in the United States. Inflation expectations have also lifted from near record lows to be now closer to central banks' targets.

The 3-year government bond yield in Australia is at the Board's target of 10 basis points and lending rates for most borrowers are at record lows. The Australian dollar remains in the upper end of the range of recent years.

Economic recovery in Australia

The economic recovery in Australia is well under way and is stronger than had been expected. The unemployment rate fell to 5.8 per cent in February and the number of people with a job has returned to the pre-pandemic level. GDP increased by a strong 3.1 per cent in the December quarter, boosted by a further lift in household consumption as the health situation improved.

The recovery is expected to continue, with above-trend growth this year and next. Household and business balance sheets are in good shape and should continue to support spending.

Wage and Price Pressures

Nevertheless, wage and price pressures are subdued and are expected to remain so for some years. The economy is operating with considerable spare capacity and unemployment is still too high.

It will take some time to reduce this spare capacity and for the labour market to be tight enough to generate wage increases that are consistent with achieving the inflation target.

Inflation

In the short term, CPI inflation is expected to rise temporarily because of the reversal of some COVID-19-related price reductions. Looking through this, underlying inflation is expected to remain below 2 per cent over the next few years.

Housing Markets

Housing markets have strengthened further, with prices rising in most markets. Housing credit growth to owner-occupiers has picked up, with strong demand from first-home buyers.

In contrast, investor credit growth remains subdued. Given the environment of rising housing prices and low interest rates, the Bank will be monitoring trends in housing borrowing carefully and it is important that lending standards are maintained.

3-Year Government Bond Yield Target

The Board remains committed to the 3-year government bond yield target of 10 basis points. Later in the year it will consider whether to retain the April 2024 bond as the target bond or to shift to the next maturity. The initial $100 billion government bond purchase program is almost complete and the second $100 billion program will commence next week.

Beyond this, the Bank is prepared to undertake further bond purchases if doing so would assist with progress towards the goals of full employment and inflation. Authorised deposit-taking institutions have drawn $95 billion under the Term Funding Facility and have access to a further $95 billion. Since the start of 2020, the RBA's balance sheet has increased by around $215 billion.

Low Costs of Financing

These various monetary measures are continuing to help the economy by keeping financing costs very low, contributing to a lower exchange rate than otherwise, and supporting the supply of credit and household and business balance sheets. Together, monetary and fiscal policy are contributing to the recovery in aggregate demand and the pick-up in employment.

The Board is committed to maintaining highly supportive monetary conditions until its goals are achieved.

The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.

Cash Rate Reduced by 0.15% to a record low of 0.10%

3 Nov 2020 | Source: Real Estate Investar

Statement by Philip Lowe, Governor: Monetary Policy Decision

At its meeting today, the Board decided on a package of further measures to support job creation and the recovery of the Australian economy from the pandemic.

With Australia facing a period of high unemployment, the Reserve Bank is committed to doing what it can to support the creation of jobs. Encouragingly, the recent economic data have been a bit better than expected and the near-term outlook is better than it was three months ago.

Even so, the recovery is still expected to be bumpy and drawn out and the outlook remains dependent on successful containment of the virus.

The elements of today's package are as follows:

• a reduction in the cash rate target to 0.1 per cent

• a reduction in the target for the yield on the 3-year Australian Government bond to around 0.1 per cent

• a reduction in the interest rate on new drawings under the Term Funding Facility to 0.1 per cent

• a reduction in the interest rate on Exchange Settlement balances to zero

• the purchase of $100 billion of government bonds of maturities of around 5 to 10 years over the next six months.

Under the program to purchase longer-dated bonds, the Bank will buy bonds issued by the Australian Government and by the states and territories, with an expected 80/20 split.

These bonds will be bought in the secondary market through regular auctions, with the first auction to be held this Thursday for Australian Government securities. Further details of the auctions are provided in the accompanying market notice.

The Bank remains prepared to purchase bonds in whatever quantity is required to achieve the 3-year yield target. Any bonds purchased to support this target would be in addition to the $100 billion bond purchase program.

At today's meeting, the Board also considered an updated set of economic forecasts.

Global Economy

The global economy has been recovering from the initial virus outbreaks, with the recovery most advanced in China.

Even so, output in most countries remains well short of pre-pandemic levels and recent virus outbreaks pose a downside risk to the outlook, particularly in Europe.

Australia Economy

In Australia, the economic recovery is under way and positive GDP growth is now expected in the September quarter, despite the restrictions in Victoria. It will, however, take some time to reach the pre-pandemic level of output.

In the central scenario, GDP growth is expected to be around 6 per cent over the year to June 2021 and 4 per cent in 2022.

Unemployment Rate

The unemployment rate is expected to remain high, but to peak at a little below 8 per cent, rather than the 10 per cent expected previously. At the end of 2022, the unemployment rate is forecast to be around 6 per cent.

This extended period of high unemployment and excess capacity is expected to result in subdued increases in wages and prices over coming years. In underlying terms, inflation is forecast to be 1 per cent in 2021 and 1½ per cent in 2022. In the most recent quarter, year-ended CPI inflation was 0.7 per cent and, in underlying terms, inflation was 1¼ per cent.

The Board views addressing the high rate of unemployment as an important national priority. Today's policy package, together with the earlier measures by the RBA, will help in this effort.

The RBA's response is complementary to the significant steps taken by the Australian Government, including in the recent budget, to support jobs and economic growth.

The combination of the RBA's bond purchases and lower interest rates across the yield curve will assist the recovery by: lowering financing costs for borrowers; contributing to a lower exchange rate than otherwise; and supporting asset prices and balance sheets.

At the same time, the RBA's Term Funding Facility is contributing to low funding costs and supporting the supply of credit to the economy. To date, authorised deposit-taking institutions have drawn $83 billion under this facility and have access to a further $104 billion.

Employment and Inflation

Given the outlook for both employment and inflation, monetary and fiscal support will be required for some time. For its part, the Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently.

This will require significant gains in employment and a return to a tight labour market. Given the outlook, the Board is not expecting to increase the cash rate for at least three years.

The Board will keep the size of the bond purchase program under review, particularly in light of the evolving outlook for jobs and inflation. The Board is prepared to do more if necessary.

Reserve Bank holds cash rate steady, experts predict November cut

6 Oct 2020 | Author: Sue Williams | Source: Domain.com.au

The Reserve Bank of Australia has again agreed to hold the official interest rate at the historic low of 0.25 per cent at its monthly meeting – unmoved from late March.

A number of economists had forecast there might be a cut in the cash rate and yield curve targets on Tuesday to help boost the COVID-19-hit economy, but the bank has remained steady.

Now experts predict instead that the bank will assess the measures in the federal budget delivered on the same day before making a change next month instead, with some disappointed by the delay.

“I think it would have been better for the Reserve Bank to cut rates for the simple reason that, by cutting rates on the same day as the federal budget, they would get bigger bang for their buck,” said AMP Capital chief economist Dr Shane Oliver.

“It would have given the impression of another Team Australia event – much like back in March – where we had the two arms of policy working in the same direction. The Reserve Bank has said on numerous occasions that it was considering easing the rate and I think they will now in November, but it would have had a bigger impact coming on the same day as the announcement on stimulus measures in the budget.”

The Reserve Bank board, responsible for formulating monetary policy, could have chosen to cut the rate with the intention of providing more domestic stimulus for an economy which is currently experiencing its biggest contraction since the 1930s.

With the government expected to announce an array of budget measures in its fiscal armoury, like tax cuts and infrastructure spending, some economists believe the two together could give the country its best chance of climbing earlier out of a recession.

“But the Reserve Bank has decided instead to wait until November and see what the government has done with the budget and will then work out the best way it can support the economy, signalling the possibility of lower rates then,” said Alex Joiner, chief economist of IFM Investors.

“Most people expect interest rates will move a little lower then which will assist people from a cash flow perspective in managing their mortgages, making them cheaper and helping others get into the housing market. But will it help business investment and create more jobs?”

With the target cash rate – the market interest rate on overnight funds – already so low, the Reserve Bank seems to want to hold its fire for later.

Tim Reardon, chief economist at the Housing Industry Association, said, “Given all the uncertainty in the economy at the moment, they’ve decided to hold for the moment.

“Interest rates are one of the few levers left, and the cabinet now has to use the tools at its disposal before the Reserve Bank uses its tools. All the interest should now be on the fiscal side, and the only tools that will help are migration and expenditure.”

Sean Langcake, senior economist at BIS Oxford Economics, says a cut in the rate may not have made much difference anyway.

“The major headwind facing the economy is lack of demand so a minor change in the interest rate would be unlikely to have a huge effect on growth momentum. The main game is really the measures that fiscal policy can deliver.

“But the Reserve Bank is keeping its policy settings at a really accommodative level. It’ll be a long time before inflation and unemployment rate are on track so we’ll see no change in policy settings for quite some time.”

NAB Group chief economist Alan Oster is even more blunt about the Reserve Bank’s decision to hold, over its option to cut.

“It really doesn’t matter,” he said. “To be brutally honest, the big thing now is fiscal policy; it isn’t monetary policy. The Reserve Bank is trying to make sure that there’s lots of liquidity out there but it’s not about supply at this point, it’s all about demand.

“The incentive isn’t borrowing because the cash rate could be a few points lower – that’s garbage. The big picture today is the budget. If the Reserve Bank can help, they will, but there’s not much they can do.”

By holding the current rate steady, it means that the Reserve Bank still has some room to move if the situation worsens. If it had cut the rate now, having already indicated that it doesn’t want to enter the uncertain world of negative interest rates, it would have almost exhausted what it could do for the economy in the future.

“Now the Reserve Bank still has levers to pull on the interest rate side,” said Mr Reardon. “They still have tools left in their arsenal.”

And Mr Oster agrees. “The Reserve Bank has already said there won’t be negative rates, so now there’s still something left they can effectively do to help the real economy.”

RBA holds rates at record low and maintain fiscal policy at September meeting

1 September 2020 | Author: Joel Robinson | Source: Property Observer

The RBA continued to hold rates at a record low 0.25 per cent and maintain its current policy settings at its September meeting.

Experts say they have never felt better about housing affordability around the country, according to Finder.com.au's RBA Cash Rate Survey of 40 experts and economists.

62 per cent of participants responded with positive sentiment about housing affordability, a record percentage since Finder first started collecting data on it in March 2018.

Graham Cooke, insights manager at Finder, said housing affordability is a two-way street.

“When experts feel good about housing affordability there are two ways to look at it.

“On the one hand, prices are down so those who are ready to buy or who want to negotiate rent are in a good position to do so.

“On the other hand, those who own or are looking to sell, may see that their property isn’t worth what it once was.

“What is certain here is that the drop in prices, rock-bottom rates and increased competition for non-investment buyers combined with government stimulus will likely get a lot of the next generation onto the housing ladder for the first time,” Cooke said.

Finder's Economic Sentiment Tracker gauges experts' confidence in five key indicators: housing affordability, employment, wage growth, cost of living and household debt.

CreditorWatch chief executive Patrick Coghlan says the RBA's decision to hold interest rates was a sensible measure to ensure cash stays in the economy as much as possible.

"This follows last month’s extension of the JobKeeper and JobSeeker schemes that demonstrate the extent to which the government is having to step in and support the economy," Coghlan said.

"However, our concern is that government support, in whatever form, will have to come to an end eventually and when it does, there will be a seismic shock as companies have to fend for themselves or admit defeat.

CreditorWatch's data showed there was a 15 per cent increase in credit enquiries in the first few weeks of August compared to the July average.

"This is an important indicator that businesses are starting to onboard new customers.

"Whilst we can’t count on green shoots just yet, it's my view that government stimulus packages should be eased off, where possible, to avoid just kicking the can down the road.”

Savers stung by falling rates, despite no likely RBA cut

1 September 2020 | Source: Property Observer

Saving rates have continued to plunge even though the Reserve Bank isn’t expected to cut the cash rate today, says Australian financial comparison website RateCity.

RateCity analysis shows that more than 40 banks cut saving account rates, including CBA, NAB, Macquarie Bank and AMP.

Average ongoing saving rates now sit at 0.59 per cent.

Research director Sally Tindall says complacent savers are earning next to nothing in this low rate environment.

“Seventy-six per cent of all household deposits are held by the big four banks, yet they’re the ones offering some of the lowest ongoing savings rates on the market.”

Westpac is the only big bank bucking the trend, offering an impressive 3 per cent rate for customers aged 18 to 29.

At the same time interest rates have continued to fall, deposits have hit an all-time high, according to the latest APRA statistics.

This means banks don’t need to attract new savers, Tindall says.

“They can’t even afford to offer respectable returns to the customers they’ve got.”

Just last week, Macquarie Bank slashed its introductory rate by 0.50 per cent to 1.50 per cent while AMP terminated its welcome rate altogether.

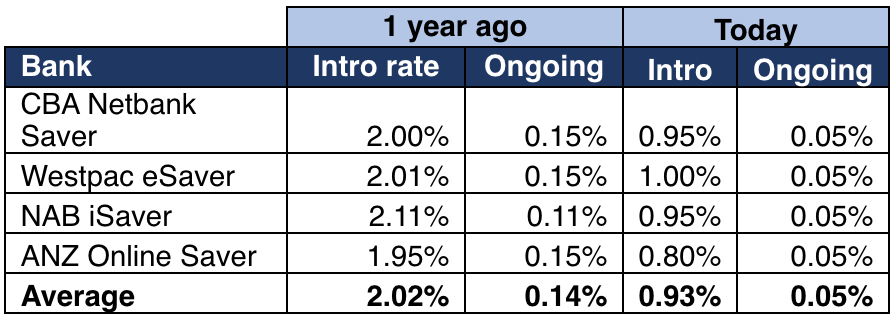

Introductory rates across the big four banks have dropped by an average of 1.12 per cent while the ongoing savings rate has dropped by 0.09 per cent.

The average cash rate has dropped by 0.75 per cent in the last year for the big four, while the conditional savings rate has dropped to 0.92 per cent.

Coronvirus triggers RBA March cash rate call

03 March 2020 | Cameron Micallef | Source: Real Estate Business

The Reserve Bank of Australia (RBA) has announced its decision on the official cash rate for March amid speculation the fallout from COVID-19 would force the bank to ease monetary policy.

The RBA has announced its fourth rate cut in the past 12 months, slashing an already historically low interest rate to 0.5 per cent.

Today’s announcement follows a reduction to 1.25 per cent in June, 1 per cent in July and 0.75 per cent in October, with the central bank looking to restore market confidence following a 12 per cent reduction in Australian equities in the last seven days.

Before the rate announcement, comparison site Finder surveyed 39 leading economists with 90 per cent believing a rate cut would happen in 2020.

One of the economists who predicted today’s cut, AMP Capital’s Dr Shane Oliver, believes back-to-back disasters are hurting the Australian economy.

“The coronavirus outbreak coming on the back of the bushfires is likely to see the economy go backwards this quarter which in turn is likely to push unemployment up further after the rise to 5.3 per cent seen in January.”

“Growth should rebound in the March quarter but given the uncertainty around Covid-19 and its impact globally there is much uncertainty around that and given we are so far from full employment and the inflation target the RBA is likely to take cut the cash rate again in the months ahead,” Dr Oliver explained.

Today’s cut has brought the official cash rate to 0.50 per cent, just one cut from the point where the RBA would consider instituting a quantitative easing program.

The RBA’s reduction is in line with market expectations internationally with it being widely expected for central banks around the world to ease monetary policy.

Bill Nelson, chief economist at the Bank Policy Institute and a former Fed economist, said the Fed and other major central banks, possibly including China’s, could announce coordinated rate cuts by Wednesday morning. The cut would at least be a half-point and perhaps even three-quarters, he said.

“The only way to get a positive market reaction is to deliver more than expected,” he said.

RBA Holds Rates at December Meeting

3 December 2019 | Source: Property Observer

The Reserve Bank of Australia have kept the official cash rate at a record low 0.75 per cent at its December meeting today.

"There are further signs of a turnaround in established housing markets," Lowe said.

"This is especially so in Sydney and Melbourne, but prices in some other markets have also increased recently.

The RBA are waiting to see if their three cuts in 2019 will stimulate the local economy enough that a further cut isn't required.

NAB however are forecasting disappointing GDP growth of 0.3 per cent in Q3, slowing marginally from the growth rates seen in the last two quarters and a continuation of the weakness seen over the past year.

"NAB's expectation is that the RBA will ease rates by a further 25bp in February, with the risk that it will ease a further 0.25 per cent an announce unconventional policy should a material fiscal stimulus fail to materialise,", NAB advise.

Two-thirds of Finder RBA's Cash Rate Survey, a survey of economists and experts, also predict a cut to 0.5 per cent in February.

Julie Toth of the Australian Industry Group said in the absence of tax reform, cuts are one of the only moves the RBA can make.

"Australia's economy is failing to accelerate (again) in 2019-20", Toth said.

“Non-mining business investment remains especially weak, but it is sorely needed to boost our productivity growth and real incomes for all.

“In the absence of meaningful tax reform and micro-economic reform, another rate cut probably won't help much, but it is the only response that the RBA can offer," Toth added.

Westpac's Bill Evans says the RBA will cut rates to 0.25 per cent by June 2020.