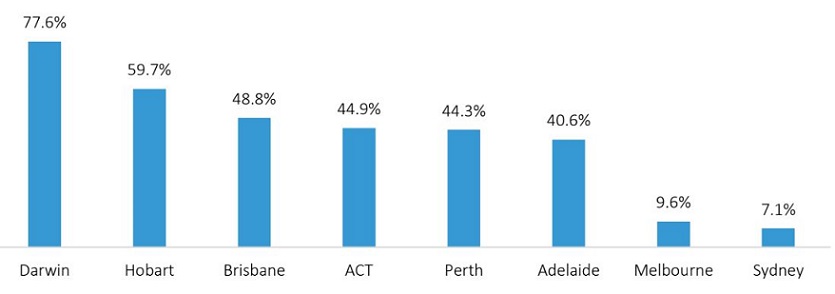

Where Is a Mortgage Cheaper Than Rent?

Portion of properties with cheaper estimated mortgage repayments than rent

Source: CoreLogic

At a greater capital city level, Darwin was the region where mortgage serviceability cost less than renting in most cases—77.6 per cent of Darwin properties have lower estimated mortgage repayments than rental costs.

On the other end of the spectrum, the phenomenon only occurs for 7.1 per cent of all Sydney properties.

These few Sydney properties are concentrated in areas where high levels of unit supply have suppressed price growth, but there is still plenty of rental demand, such as in Parramatta, Auburn and the Sydney CBD.

The varied dynamics across the cities also have to do with how property values have responded to interest rate reductions.

The more property values increase in response to lower mortgage rate, the more the benefits of a low interest rate are eroded.

In Sydney, a relatively high supply of rental stock has exacerbated the gap between mortgage repayments and rents.

Following a round of cash rate reductions from June 2019, Sydney dwelling values shot up 11.2 per cent between June 2019 and January 2020, while Darwin dwellings fell 2.4 per cent in the same period.

The data also highlights areas where rents increase more quickly than property values. For example, rent value growth across Hobart was 5.8 per cent in the year to January, outpacing dwelling market value growth of 5.0 per cent.

In some instances, relatively expensive rent payments can be a result of a highly transitory location—such as a mining location, university towns or city CBDs.

Rental markets can face more pressure because residents may prefer renting to owning.

But another instance in which residents are dependent on the rental market is where they have no option to buy.