Three of the Big Four banks now offering home loan cash backs

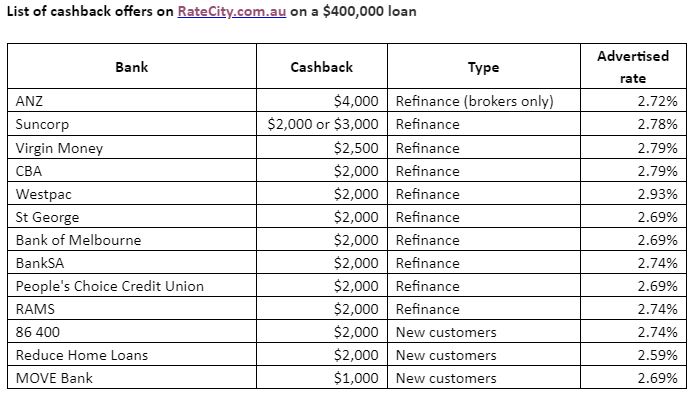

More than a dozen lenders are offering cash incentives for home owners willing to move their business to a new lender, with Suncorp Bank, Reduce Home Loans and 86 400 the latest, according to RateCity.

Suncorp Bank is now offering up to $3,000 to refinancers, plus an additional $1,000 for people working in essential services roles, such as doctors, nurses, teachers and police officers.

A total of 13 banks currently have cashbacks on offer, including three of the big four banks – CBA, Westpac and ANZ.

RateCity.com.au crunched the numbers based on someone refinancing their loan with $400,000 remaining to see whether they would be ahead or behind after picking a cashback special over one of the lowest rates in the market.

Sally Tindall, research director at RateCity.com.au, said while low rate loans were usually more cost effective, the tide was turning as the bigger banks chase after new customers more aggressively.

“Cashback specials are nothing new. They’ve been used for years as a clever marketing tool to grab people’s attention. What’s changed is the banks are starting to offer cashback on loans that also have competitive rates,” she said.

“Someone who refinances every couple of years to a competitively priced loan could potentially come out on top by taking up a cashback special."

“However, over the long term it’s a completely different story. A low rate is almost certainly going to trump a one-off perk over 10 or 20 years – often by tens of thousands of dollars."

“While the promise of cold hard cash is hugely attractive for anyone juggling the bills, people who put the money back into their mortgage will see even bigger savings as it will reduce their interest charges every single day," she concluded.