31 lenders offering home loan rates under 2 per cent

A record 31 lenders are offering, or set to offer, at least one mortgage rate under 2 per cent – almost triple the number before last week’s RBA cut.

Already 17 of these lenders have advertised rates under 2 per cent, while a further 14 lenders will make their new rates available in the coming days.

RateCity.com.au database analysis:

• 41 lenders have so far announced cuts to rates since last Tuesday.

• Of these, just 5 lenders have passed on variable rate cuts to their existing customers (see list below).

• 1.77% is the lowest variable rate on the market.

• 1.88% will be the lowest fixed rate on the market (2-years), effective from 19 November.

• 31 lenders are set to offer at least one fixed or variable rate under 2%.

• Australia’s three largest banks now have fixed rates under 2% (CBA, Westpac and NAB).

Homeowners can now get 1-5 year fixed loans for under 2%

In an historic first, homeowners can now sign up for a one, two, three, four and five-year fixed loan –for under 2 per cent.

Locking in a rate is becoming an increasingly popular option for Australian mortgage holders, with CBA telling RateCity that around 40 per cent of new loans were fixed, while Westpac has said 28 per cent of their entire loan book is on a fixed rate.

Lowest owner-occupier rates on RateCity.com.au - Note some rates will become available later this month.

| Lender | Advertised rate | |

| Variable | Reduce Home Loans |

1.77% |

| 1-year fixed | Homestar Finance/ Newcastle Permanent |

1.98% |

| 2-year fixed | HSBC |

1.88% |

| 3-year fixed | UBank |

1.95% |

| 4-year fixed | Westpac/ St George/ Bank of Melbourne |

1.89% |

| 5-year fixed | Newcastle Permanent |

1.99% |

Source: RateCity.com.au Home loans above are available Australia-wide. LVR restrictions may apply. HSBC rate available from 19/11. UBank rate available 13/11. Newcastle Permanent rate available 11/11.

Big four banks – lowest owner-occupier rates

| CBA | Westpac | NAB | ANZ | |

| 1 year fixed |

2.19% |

1.99% |

2.19% |

2.09% |

| 2 year fixed |

2.14% |

1.99% |

2.09% |

2.09% |

| 3 year fixed |

2.14% |

1.99% |

2.09% |

2.09% |

| 4 year fixed |

1.99% |

1.89% |

1.98% |

2.29% |

| 5 year fixed |

2.99% |

2.69% |

2.79% |

2.29% |

| Lowest variable rate |

2.69% |

2.19% for 2 yrs |

2.69% |

2.72% |

Source: RateCity.com.au Note: Westpac's rates are for a loan to value ratio of 70%.

RateCity.com.au research director Sally Tindall said: “At the beginning of this year, no one would have predicted there would be more than 30 lenders with rates under 2 per cent.”

“It’s no longer just online lenders with low rates. The bigger banks are now starting to steal their thunder offering up fixed rates under 2 per cent,” she said.

“For the average borrower, refinancing to a low fixed rate could save them thousands of dollars a year but locking in is not for everyone.

“Don’t rush into fixing. Make sure you’re happy with the rate but also with the terms and conditions that come with a fixed rate.

“Split loans can be a good option for people looking to take advantage of the record low fixed rates but still want to keep their offset or make extra repayments,” she said.

RateCity Tips: What to consider before committing to a fixed rate mortgage

• Are you happy with the rate?

• How many years you want to fix your home loan for?

• What’s your plan for the property – are you likely to sell?

• Would a split loan work for your finances? Spilt loans where a portion is variable can often help retain some flexibility in the loan.

• Do you want to make extra repayments or have the flexibility of an offset?

Lenders passing variable rate cuts onto existing customers

| Lender | Cut | New lowest variable | Effective date |

| Athena Home Loans |

-0.15% |

2.19% |

Nov-03 |

| Homeloans.com.au |

-0.15% |

2.14% |

Nov-06 |

| Me Bank |

-0.15% |

2.43% |

Nov-26 |

| P&N Bank |

-0.10% |

2.49% |

Nov-20 |

| UBank |

-0.15% |

2.34% |

Nov-29 |

Source: RateCity.com.au

Complete List of Lenders with rates under 2%

| AMP Bank | 1.97% | 3-yr fixed |

| Bank First | 1.99% | 3-yr fixed |

| Bank of Melbourne | 1.89% | 4-yr fixed |

| BankSA | 1.99% | 4-yr fixed |

| Bankwest | 1.99% | 4-yr fixed |

| BOQ | 1.99% | 4-yr fixed |

| CBA | 1.99% | 4-yr fixed |

| Citi | 1.99% | 2-yr fixed |

| CUA | 1.97% | 3-yr fixed |

| Freedom Lend | 1.97% | variable |

| Greater Bank | 1.99% | 1-yr fixed |

| Homestar Finance | 1.79% | variable |

| HSBC | 1.88% | 2-yr fixed |

| Hume Bank | 1.99% | 3-yr fixed (construction) |

| Illawarra Credit Union | 1.99% | 2-yr fixed |

| IMB Bank | 1.97% | 3-yr fixed |

| ING | 1.99% | 4-yr fixed |

| loans.com.au | 1.99% | 3-yr fixed |

| Mortgage House | 1.94% | variable |

| NAB | 1.98% | 4-yr fixed |

| Newcastle Permanent | 1.98% | 1-yr fixed |

| P&N Bank | 1.99% | 1-yr fixed |

| Pacific Mortgage Group | 1.89% | variable |

| People's Choice Credit Union | 1.99% | 4-yr fixed |

| RACQ Bank | 1.99% | 3-yr fixed |

| RAMS | 1.99% | 4-yr fixed |

| Reduce Home Loans | 1.77% | variable |

| St.George Bank | 1.89% | 4-yr fixed |

| Suncorp Bank | 1.89% | 2-yr fixed |

| Ubank | 1.95% | 3-yr fixed |

| Westpac | 1.89% | 4-yr fixed |

![]()

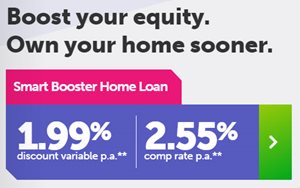

A second record low 1.99% home loan has arrived

Date: 23 July 2020 | Source: Property Observer

| Lender loans.com.au has introduced a record low discounted variable rate of 1.99%, available for one year before it reverts to 2.57%. The move comes less than one month after Tasmanian customer owned bank, Bank of Us introduced fixed rates of 1.99%. With loans.com.au’s new lowest variable rate of 1.99% only available for one year, Canstar has compared the interest paid over the 30 year life of the loan between the new offer and the current lowest variable rate of 2.19%. The analysis reveals that taking out the introductory offer of 1.99% would see borrowers with lower monthly repayments for 12 months though it will cost $25,517 more in interest over the life of the loan (assuming the rate differential stays the same). |

|

Canstar's finance expert, Steve Mickenbecker said,“just last month we saw fixed rates crack the 2% barrier, with variable rates now following suit, albeit with an introductory rate that moves higher after 12 months.”

“The four minute mile of home loans, a rate below 2%, was broken last month and with the barrier broken we are now seeing fast followers.

“We saw how quickly the competition moved below 3% once that record fell, so a rate below 2% could soon become the qualifying rate to be competitive.

“A rate below 2% could make a big difference to homeowners’ hip pockets each month, but borrowers have to be prepared for a higher monthly repayment when the 12 month introductory period expires, even though the ongoing rate is competitive.

“Switching from the average variable rate of 3.44% to a rate of 1.99% on an average $400,000 loan could put $307 per month or over $3,600 back into borrowers wallets in just the first year,” he concluded.

|

More than a dozen lenders are offering cash incentives for home owners willing to move their business to a new lender, with Suncorp Bank, Reduce Home Loans and 86 400 the latest, according to RateCity.

|

|