RBA to cut cash rate to 0.75% in October & to 0.50% in February

We are bringing forward the timing of our forecast for the next cut in the overnight cash rate by the RBA from November to October. By October, we expect that the path of the unemployment rate will be sufficiently contrary to the RBA’s plans that they will have appropriate justification to ease policy a little earlier than we had previously expected.

We recognise that September is also likely to be a “live” meeting but expect the Board will wait for more data, such as the June quarter national accounts, before moving again.

We are also revising down our terminal rate forecast from the 0.75% we forecast on May 24 to 0.50%. We expect the move from 0.75% to 0.50% to occur in February next year

DEVELOPMENTS SINCE OUR LAST FORECAST CHANGE ON MAY 24

Since we announced the 0.75% target terminal rate on May 24 a number of factors have strengthened the case for an even lower terminal rate.

The AUD is providing less support than expected. At the time of our May 24 forecast, markets had not priced in the prospect of a 0.75% terminal rate by year’s end.

We expected that as markets moved in that direction the AUD would adjust accordingly. Markets have indeed moved to price in that move but the AUD has actually appreciated from USD0.692 to USD 0.702, partly due to the higher terms of trade and the prospect of a lower US federal funds rate.

We expect that the near term boost to demand from the higher terms of trade will be limited by a cautious response from both the private and public sectors.

Since May 24 we have also moved to forecast an easing cycle from the Federal Reserve. Lower rates globally are largely the result of the concern from the Federal Reserve and other central banks around world growth and deteriorating global trade.

Some data releases since May 24 have also highlighted downside risks for demand, wages and the labour market. In particular we have been surprised by the response of consumer sentiment to the rate cuts in June/July, having fallen by nearly 5%. Furthermore, our measure of unemployment expectations has also deteriorated markedly.

Our forecasts of inflation and unemployment emphasise the extent of the challenge faced by the RBA in boosting demand and wages and reaching their own targets. We expect that the RBA will eventually see only one more rate cut, in October, as being an insufficient response.

RBA’S CHALLENGE AROUND ITS FORECASTS

In its Statement on Monetary Policy (SMP), which will be released on August 9, the RBA is expected to lower its growth forecast for 2019 from 2.75% to 2.50% but retain its current forecast for growth in 2020 to be at trend 2.75%.

On inflation we expect that following the print of the June quarter Consumer Price Index on July 31 the Bank will have to lower its forecast for underlying inflation (trimmed mean) from 1.75% in 2019 to 1.50% and from 2.00% to 1.75% in 2020.

In the August SMP, forecasts for December 2021 will be released and the RBA’s trimmed mean forecast is expected to lift to 2%. The RBA will be signalling an eventual return to the 2–3% target band although the journey will take a year longer.

The real difficulty will come with the unemployment rate where the actual for June has just printed 5.24% compared to the RBA’s forecast of 5.0% in May. In May the RBA was only able to forecast that the unemployment rate would hold steady at 5.0% in both the remainder of 2019 and 2020. That was essentially because it was only prepared to forecast trend growth in 2019 and 2020.

A fair rule of thumb is that the unemployment rate can only be credibly forecast to fall if growth is expected to be above trend.

Note that the forecasts in May assumed market pricing which at the time had discounted two 25 bp rate cuts by year’s end. Accordingly the August forecasts cannot be significantly lifted as a result of the rate cuts that have already occurred.

However, the cuts have come earlier than expected by the market at the time of the May forecasts and it is now discounting a further cut by year’s end. Those factors provide some further market support for the RBA’s August forecasts.

The unemployment forecast is going to challenge the RBA Governor given his stated desire to drive the unemployment rate down to 4.5%.

Westpac’s own forecast for the unemployment rate by end 2019 is 5.4%. A range of our leading indicators – the Westpac Jobs Index and the Westpac Index of Unemployment Expectations – signal a continuation of the current slowdown in employment growth over the remainder of 2019 and into 2020.

With the unemployment rate holding or drifting higher there seems little justification to delay the cut to 0.75% to November. We expect an October move while recognising that September will be a “live” meeting.

This is a relatively minor adjustment to Westpac’s forecast released on May 24, when we were the first in the market to forecast a cash rate below 1.0%.

At the time we signalled downside risks to that terminal rate but chose to stick with 0.75% partly due to uncertainty about the effectiveness of any cuts below 0.75%.

The response by the banks to the move in the cash rate to 0.75% will be an indicator to the RBA of the likely effectiveness of any further cuts.

AN ALTERNATIVE APPROACH TO MAXIMISE THE IMPACT OF A RATE CUT

However, there may be a way in which the RBA could ensure an effective response of a cut to 0.50%.

When the Bank of England cut the Bank Rate from 0.50% to 0.25% following the Brexit vote in June 2016, it supported the economy through a four pronged strategy. This was highlighted by the Bank Rate cut being accompanied by the Term Funding Scheme, a form of policy designed to “encourage banks to pass on cuts in Bank Rate to customers” (boost household demand). The Term Funding Scheme allowed banks (and building societies) to borrow from the Bank of England on a secured basis (subject to appropriate haircuts) at the new Bank Rate.

In supporting the package, The Bank of England noted that:

“Evidence from a number of economies suggests that, as the level of interest rates set by the central bank becomes lower, the extent to which further cuts are passed on by commercial banks and building societies to other interest rates in the economy decreases, making monetary policy less effective... The potential difficulty, from a monetary policy transmission perspective, arises when interest rates are close to zero because it is likely to be difficult for banks and building societies to reduce deposit rates much further. This constraint means that lenders may then face a choice between reducing the pass through of lower official rates to those they charge on loans — in particular rates on new loans — or a period of lower profitability, which, were it to persist, could reduce the supply of lending.”

(Bank of England Quarterly Bulletin, 2018 Q4)

Adopting a package of instruments, alongside a cut in the Bank Rate, ensured the effectiveness of the rate cut (in time, 24 bps of cuts in the variable mortgage rate followed the 25 bp cut in the Bank Rate) and avoided the confidence drag from adopting an “emergency measure” later on, such as a term lending program or asset purchase facility in isolation.

Banks found that the alternative costs of funding – wholesale and term retail funding – were considerably more expensive (around 70bps) than the drawdown costs of the program.

IMPORTANT TO CHOOSE A PACKAGE BEST SUITED TO THE AUSTRALIAN FINANCIAL SYSTEM

The point is that the combination of a rate cut and a financial package appears to have been quite effective in maximising the impact of the cut. The details of any domestic package, of course, would need to be best suited to the Australian financial system.

Alternatively, the market’s response to the move to 0.75% might be sufficiently encouraging for the RBA to make the cut to 0.50% without any supporting package.

At a public forum on July 23rd, I asked the RBA Assistant Governor (Financial Markets) Kent about prospects for other RBA policies to support demand in addition to rate cuts. He indicated that the RBA was unlikely to adopt unconventional policy measures, although he was clear that the RBA had considered a number of policies that had been implemented elsewhere in the world from the perspective of what would be most effective in the Australian financial system.

Consequently in the near term there seems little prospect of the RBA adopting a package of policies which would support the effectiveness of its interest rate policies.

Our forecast is that the RBA will cut the cash rate to 0.50% in February. It may be prepared to link the move with a package of other policies, most appropriate for the Australian financial system, that would result in an effective reduction in the mortgage and business interest rates to ensure effective pass through of the rate cut.

However, we emphasise that the rate cut we envisage in February is not conditional on an associated package of other policies.

BILL EVANS is Chief Economist for Westpac

UPDATE: Official cash rate on its way to 0.5%, says one third of Finder's RBA Survey experts

17 Jul 19 | Source: Urban.com.au

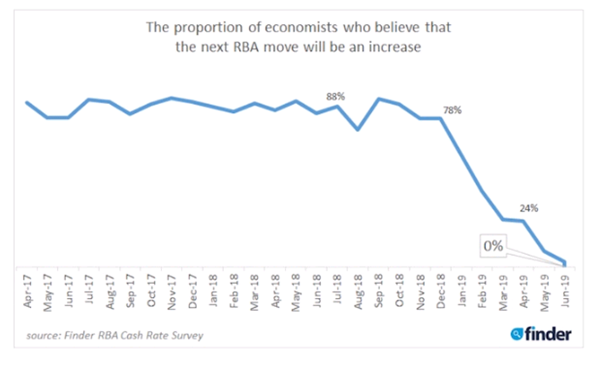

Nearly a third of experts and economists surveyed in Finder.com.au's RBA Cash Rate Survey predict the RBA to bring the official cash rate all the way down to 0.5 percent.

Just over 70% of experts predict the bottom of the cycle at 0.75%.

The numbers are more convincing in favour of a rate cut in July, with 68% tipping a second cash rate cut in as many months.

Graham Cooke, insights manager at Finder, said lenders should be gearing up to get busy with further rate reductions.

“The RBA will have its scissors out for the foreseeable future to try to stimulate inflation and reduce unemployment, and lenders should be ready to follow suit.

“The heat is on for those banks who only passed on a partial rate cut (less than 25 basis points) after the June rate reduction.

"Doing the right thing by their customers this time around – by passing on a cut in its entirety – could see them redeem themselves,” he said.

“So far, we’ve seen more than 700 variable rate products reduced in June alone, with more than 1,000 rates reduced if you include fixed rate loans.

Across all of the variable rates Finder compares, the average rate has dropped more than 20 basis points in June.

“The winners here are borrowers – they are spoilt for choice with the lowest home loan rates we’ve ever seen,” he said.

Currently, the lowest variable home loan rate on the market is 3.09% from Reduce Home Loans, while some banks (UBank and Greater Bank), are offering a one year fixed rate of 2.99%.

It was only late last year that nearly 80% of economists thought the next cash rate would be a hike.

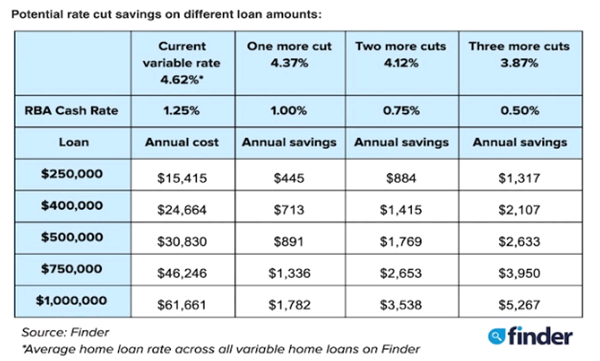

Finder research suggests two further cuts, the most popular forecast for the rest of 2019, would see a variable rate mortgage holder with a loan of $1 million save $3,538 a year.

“If the cash rate does get to 0.50%, down from 1.50% in May, and your bank were to pass on all of the four rate cuts in full, an average mortgage holder* could be saving nearly $3,000 a year on their mortgage,” Cooke said.

“Of course you don’t have to wait around for these cuts to happen – you can go home loan shopping for a better deal anytime.

“It’s a borrower’s market. A new standard has been set with sub-3% home loan rates so compare options to maximise your savings in the long run.”

Reserve Bank cuts rates to a record low of 1 per cent

7 Jul 2019 | Source: Domain.com.au | Author: Trent Wiltshire

The RBA made it clear that further interest rate cuts, in addition to Tuesday’s cut, are very likely.

The RBA stated on Tuesday that it will “continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target”.

On the Monday before the RBA’s meeting, the financial markets predicted that the cash rate would fall to 0.75 per cent by February 2020, with the possibility of it going even lower by mid-2020.

There is one key reason the RBA will continue to cut interest rates. The central bank believes the unemployment rate needs to be below 4.5 per cent to push inflation from the current rate of 1.3 per cent up into its 2 to 3 per cent target range. Typically, lower unemployment contributes to higher inflation. The RBA previously thought that an unemployment rate of about 5 per cent was low enough for inflation to reach the 2 to 3 per cent target.

With the unemployment rate currently at 5.1 per cent, lower interest rates are needed to give the economy a boost and push the unemployment rate below 4.5 per cent. So the cash rate is likely to end up at 0.75 per cent or even 0.5 per cent within the next year.

The cash rate is likely to end the year at a record low of 0.75 per cent

The cash rate is likely to end the year at a record low of 0.75 per cent

Actual and forecast cash rate

Note: Market implied forecast is the ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve.

Sources: RBA; ASXFiscal stimulus might be needed to boost the economy

The RBA has pushed the government to deploy fiscal stimulus, either in the form of increased spending or tax cuts, to provide a boost to the economy.

Dr Lowe recently stated that “we should also be looking at other ways to get closer to full employment. One option is fiscal policy, including through spending on infrastructure”.

Typically, the short-term fine-tuning of the economy is left to the RBA, with fiscal stimulus only used in times of crisis. But with interest rates approaching zero, the lowest point they can reach, fiscal stimulus may be needed to give a short-term boost to the economy.

But there are drawbacks to using fiscal stimulus to boost economic growth.

First, it is difficult for the government to inject money into the economy immediately, except in the form of tax rebates or cash handouts. The proposed “stage one” tax rebate will provide a small, but immediate, boost to household incomes if fully implemented.

Spending on infrastructure – even for planned projects – however, can take months or years to begin.

Second, there is the likelihood that money spent on infrastructure will be spent badly. Money is more likely to be allocated to projects in marginal seats, rather than on the most-needed projects.

But even so, in times of crisis, some waste may be justified to avoid the dire consequences of a recession, particularly a rise in unemployment which can scar a generation of workers.

Despite the arguments for fiscal stimulus, the government has reaffirmed its commitment to a budget surplus in 2019-20. But if the economy continues to slow and unemployment doesn’t fall the government should be open to changing its position.

Another alternative to fiscal stimulus is for the RBA to adopt unconventional monetary policies, such as by buying government bonds or other financial assets, to reduce longer-term interest rates. These strategies have been used overseas when interest rates have approached zero and would be an effective way for the RBA to boost the economy when the cash rate cannot be lowered any further.

Stabilising property prices could help the economy

We forecast that property price falls seen in most capital cities are expected to end later this year, with lower interest rates a key reason for the predicted turnaround.

The RBA stated that “[c]onditions in most housing markets remain soft, although there are some tentative signs that prices are now stabilising in Sydney and Melbourne”.

A modest turnaround in property prices should help the broader economy. Rising prices will help boost the construction sector, which is facing a downturn in the next couple of years. The end of price declines will also give a boost to very weak property sales, which will help those closely linked to the property sector, but also struggling retailers and tradespeople.

House price forecasts |

||

| 2019 (6 month change) | 2020 (annual change) | |

| Australia (combined-capital cities) | 1% | 2% – 4% |

| Sydney | 2% | 3% – 5% |

| Melbourne | 1% | 1% – 3% |

| Brisbane | 1% | 3% – 5% |

| Perth | 0% | 0% – 2% |

| Adelaide | 1% | 1% – 3% |

| Hobart | 0% | 2% – 4% |

| Canberra | 2% | 4% – 6% |

| Notes: Stratified median house price forecasts. 2019 forecast is 6 month per cent change from June quarter 2019 to the December quarter 2019. 2020 forecast is the annual per cent change from December quarter 2019 to December quarter 2020. Darwin excluded from forecasts due to small volumes and market volatility. | ||

Unit price forecasts |

||

| 2019 (6 month change) | 2020 (annual change) | |

| Australia (combined-capital cities) | 1% | 1% – 3% |

| Sydney | 2% | 2% – 4% |

| Melbourne | 1% | 0% – 2% |

| Brisbane | 0% | 0% – 2% |

| Perth | 0% | 0% – 2% |

| Adelaide | 2% | 1% – 3% |

| Hobart | 2% | 3% – 5% |

| Canberra | 1% | 1% – 3% |

| Notes: Stratified median house price forecasts. 2019 forecast is 6 month per cent change from June quarter 2019 to the December quarter 2019. 2020 forecast is the annual per cent change from December quarter 2019 to December quarter 2020. ‘Units’ includes units and apartments. Darwin excluded from forecasts due to small volumes and market volatility. | ||

More cuts to come

The official interest rate is now at a record low of 1 per cent, but the RBA is likely to cut rates even further this year. However, these cuts may not be enough to turnaround a slowing economy. Fiscal stimulus — in the form of tax cuts, cash handouts or spending on infrastructure — may be required to give the economy the boost it needs.